Mastering the Art of Budgeting: A Beginner's Guide

Budgeting is a lifestyle choice that empowers individuals by allowing them to take control of their financial futures through effective money management. It involves understanding spending habits, setting clear financial goals, tracking income and expenses, and creating a realistic budget plan that aligns with one's lifestyle and financial objectives. By staying committed to a flexible budgeting plan, individuals can achieve financial stability, reduce stress, and make informed decisions to secure a prosperous future.

Picture this: it's a lazy Sunday morning, and you're sitting at your favorite coffee shop sipping on a steaming latte. You're flipping through a magazine when an article about budgeting catches your eye. You pause, intrigued by the idea that mastering your budget might not just be a chore but an empowering lifestyle choice that could transform your financial future. You might think, "Budgeting sounds good in theory, but how do I make it work for me?" Well, that's exactly what we're going to explore today.

Budgeting is more than just a spreadsheet exercise—it's about creating a plan that fits your unique lifestyle while also securing your financial goals. Whether you're saving for a dream vacation, paying off student loans, or simply trying to get a handle on your monthly expenses, budgeting is the tool that can help you get there. It's about understanding your spending habits, setting clear financial goals, and staying committed to a plan that evolves with your life. Ready to dive in? Let's break it down.

Understanding Your Spending Habits

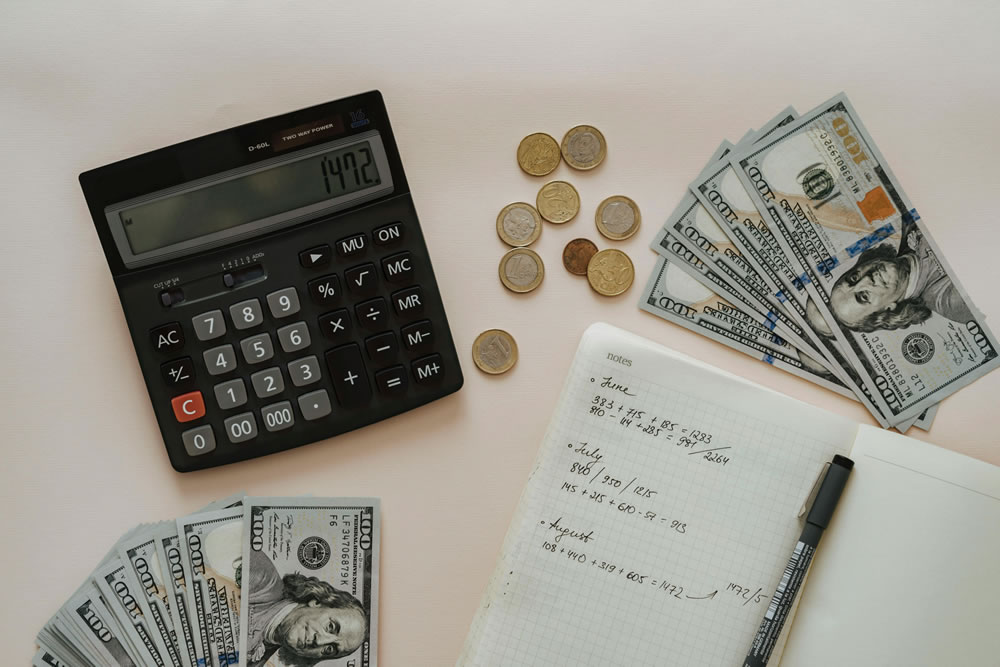

Before you can craft a budget that works, you need to know where your money is going. This means taking a close look at your spending habits. Think of it as a financial diary—track every penny you spend for at least a month. Yes, that means the morning coffee, the spontaneous online shopping spree, and even the Netflix subscription you forgot about. The goal here is not to judge yourself but to gather data. You might be surprised by what you find. According to a study by the National Endowment for Financial Education, nearly two-thirds of Americans don't track their spending, which often leads to overspending.

Once you’ve gathered enough data, categorize your expenses into needs and wants. Needs are non-negotiable expenses like rent, utilities, and groceries, while wants are things you can live without, such as dining out or luxury items. This differentiation is crucial as it helps you identify areas where you can cut back if needed. As financial advisor Jane Smith notes, "Understanding your spending habits is the first step in taking control of your financial future. It’s about making conscious choices instead of letting your money dictate your life."

Setting Clear Financial Goals

Now that you’ve got a handle on your spending, it’s time to dream a little. Setting financial goals gives your budget purpose and direction. What do you want to achieve? Maybe it's building an emergency fund, buying a house, or saving for retirement. Whatever it is, your goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of saying, "I want to save money," aim for, "I want to save $5,000 for a vacation next year."

Once you’ve set your goals, break them down into manageable steps. If your goal is to save $5,000 in a year, that means setting aside about $416 each month. Suddenly, a daunting goal feels more achievable. Remember, goals can change, and that's okay. Life happens, and your financial plan should be flexible enough to adapt. According to CNBC, revisiting and adjusting your financial goals regularly is key to staying motivated and on track.

Emergency Fund Calculator

Wondering how much you should set aside for life's unexpected moments? Our Emergency Fund Calculator helps you quickly figure out how much you need to save to cover your expenses for 3, 6, or even 12 months. Whether you're building a financial safety net or planning for job loss, medical bills, or other emergencies, this tool gives you a clear savings goal to aim for — fast and easy.

Tracking Income and Expenses

With your goals in mind, it’s time to take a hard look at your income and expenses. Start by listing all your income sources, including your salary, side gigs, or any passive income. Then, compare this to your monthly expenses. Ideally, your income should exceed your expenses, leaving room for savings and debt repayment. If not, it’s time to make some adjustments.

Tracking your income and expenses doesn’t have to be a tedious task. Thanks to technology, there are dozens of apps designed to make budgeting a breeze. Apps like Mint or YNAB (You Need A Budget) can sync with your bank accounts, track your spending, and even send you alerts when you’re nearing your budget limits. As tech journalist Sarah Johnson writes, "Budgeting apps are like having a financial advisor in your pocket. They not only keep you accountable but also help identify spending trends you might miss."

Creating a Realistic Budget Plan

Armed with a clear picture of your spending habits, financial goals, and income, you’re ready to create a budget plan. There’s no one-size-fits-all approach here, but the 50/30/20 rule is a great starting point. This rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Customize these percentages based on your unique situation.

Remember, a budget is a living document. It should evolve as your circumstances change. Maybe you get a raise, or perhaps you decide to go back to school. These changes will impact your budget, and that's okay. The key is to stay flexible and adjust as needed. As money coach David Ramsey often says, "A budget is telling your money where to go instead of wondering where it went."

Staying Committed to Your Budget

The final piece of the puzzle is commitment. It’s easy to create a budget, but sticking to it is where the magic happens. This doesn’t mean you can’t enjoy life—it’s about making informed choices that align with your goals. Set regular check-ins to review your progress and make adjustments if necessary. Celebrate small victories, like paying off a credit card or reaching a savings milestone, to keep your motivation high.

Accountability can also play a big role in staying committed. Share your goals with a trusted friend or partner who can help keep you on track. Alternatively, join an online community of like-minded individuals. As personal finance blogger Emily Jones shares, "Having a support system can make all the difference. Knowing others are cheering you on can help you stay focused and accountable."

Budgeting doesn’t have to be a daunting task. By understanding your spending habits, setting clear goals, tracking your income and expenses, and creating a realistic budget plan, you’re well on your way to financial empowerment. Remember, it’s not about perfection—it’s about progress. So, grab that latte, sit back, and start crafting a budget that works for you and your future. You've got this!