Secrets to Successfully Tackling Your Debt

To tackle debt effectively, start by listing all your debts, including details like interest rates and minimum payments, to understand your financial situation. Create a realistic budget that covers essential expenses while freeing up funds for debt repayment, and consider strategies like the debt snowball or avalanche methods to systematically eliminate debt. Additionally, explore options like debt consolidation or refinancing to simplify your repayment process, and seek professional help if needed to gain expert advice and support.

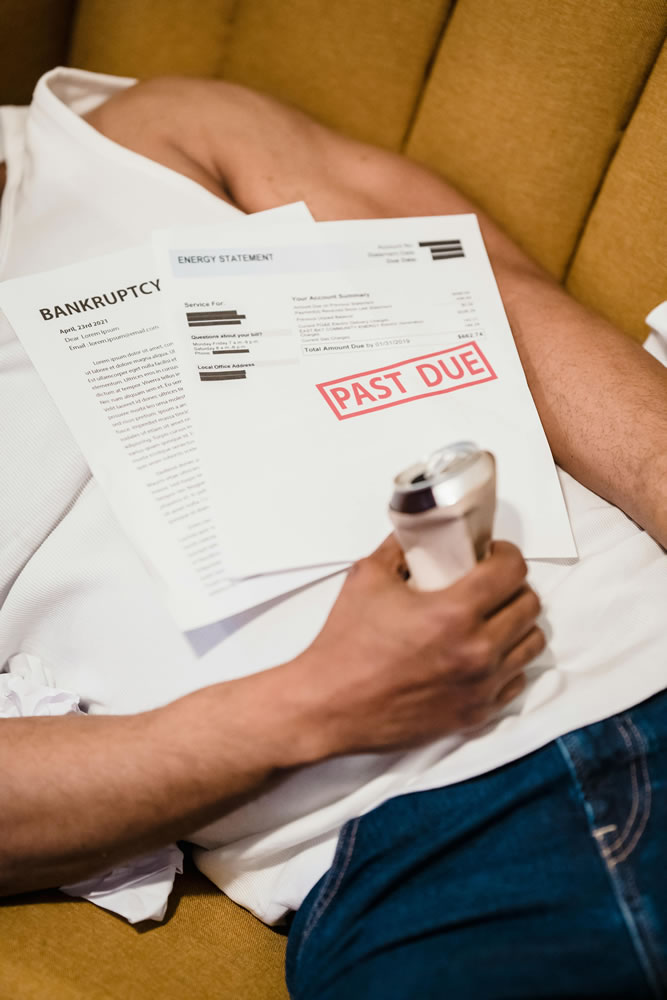

Debt. Just the word itself can bring a shiver down the spine. It's the unwanted guest that lingers in the corners of your financial life, reminding you of its presence every time you glance at your bank statement. But tackling debt doesn’t have to be akin to scaling Everest. With a bit of planning, some discipline, and a few proven strategies, you can turn what feels like an insurmountable mountain into a series of manageable hills. Picture this as a friendly chat over coffee, where we dive into the secrets of successfully managing and eliminating debt, not by waving a magic wand, but through practical and informed choices.

Before you begin, it's crucial to remember there’s no one-size-fits-all approach. The journey to becoming debt-free is as unique as the individual undertaking it. Yet, some core principles can guide anyone looking to step out from under the shadow of debt.

Understanding Your Debt Landscape

Before you can tackle your debt, you need to know exactly what you're up against. Start by listing all your debts in one place, whether they’re student loans, credit card balances, car loans, or that personal loan from Aunt Mary. Include details like interest rates, minimum payments, and due dates. This comprehensive view is your starting map.

Seeing everything laid out can be daunting, but it's also empowering. As financial advisor Jane Smith often tells her clients, "Knowing your enemy is the first step to defeating it." You might discover, for example, that a small credit card balance is accruing interest at a much higher rate than your larger student loan. This insight can help prioritize where to focus your repayment efforts.

Moreover, understanding the totality of your debt can help reduce anxiety. It's the unknown that often causes the most stress. Once you have a clear picture, you can begin to make informed decisions about how to proceed.

Crafting a Realistic Budget

Budgeting might sound like a tedious task, but it's the cornerstone of financial health. Start by tracking your expenses for a month or two to understand where your money is going. Divide your spending into categories like housing, groceries, transportation, and entertainment.

Once you have a clear picture of your spending habits, you can start crafting a budget that covers your essential expenses while freeing up funds for debt repayment. Be realistic about your needs and wants. It's okay to enjoy your daily latte if it's a priority, but perhaps you can cut back in other areas, like dining out or subscription services.

Tools like Mint or YNAB (You Need a Budget) can be invaluable in helping you visualize and adjust your spending. Remember, the goal of a budget isn't to restrict you but to give you a clear plan for your money, ensuring you have enough to cover your essentials and make meaningful progress on your debt.

Debt Payoff Calculator

Plan your financial future by estimating how long it will take to pay off your debt based on your balance, annual percentage rate (APR), and monthly payment. After entering your figures, the calculator determines the number of months needed to fully repay the debt and calculates the total interest paid over time.

Choosing a Debt Repayment Strategy

Once your budget is in place, it's time to choose a debt repayment strategy. Two popular methods are the debt snowball and the debt avalanche. The debt snowball method, popularized by financial guru Dave Ramsey, involves paying off your smallest debts first to build momentum and motivation as you see balances disappear.

The debt avalanche, on the other hand, focuses on paying off debts with the highest interest rates first, saving you more money in the long run. According to a study by the Harvard Business Review, while the avalanche method is mathematically optimal, the psychological victories of the snowball approach often lead to better adherence for many people.

Consider which method aligns best with your personality and financial goals. If seeing progress quickly motivates you, the snowball method might be your best bet. If saving on interest is your top priority, the avalanche could be more effective.

Exploring Debt Consolidation and Refinancing

Sometimes, simplifying your debt can make it more manageable. Debt consolidation involves combining multiple debts into a single loan with one interest rate and monthly payment. This can be particularly helpful if you have high-interest credit card debt. Companies like SoFi or LendingClub offer consolidation options that might lower your overall interest rate.

Refinancing, particularly for student loans or mortgages, can also reduce your interest rate or extend your repayment term, easing your monthly burden. However, it's essential to read the fine print and understand the potential downsides, such as losing certain borrower protections on federal student loans if you refinance with a private lender.

As with any financial product, shop around and compare offers before committing. According to CNBC, a lower interest rate can save you hundreds or even thousands of dollars over the life of a loan, but the terms must align with your financial strategy.

Seeking Professional Help

If you're feeling overwhelmed, remember you don't have to go it alone. Financial advisors or credit counseling services can provide expert advice tailored to your situation. Organizations like the National Foundation for Credit Counseling (NFCC) offer resources and counseling to help you create a debt management plan.

While there may be fees involved, the guidance of a seasoned professional can be invaluable, especially if you're dealing with complex debt situations or need help negotiating with creditors. As personal finance coach Lisa Fischer suggests, "Sometimes the best investment you can make is in expert advice that helps you reach your goals faster."

Never hesitate to reach out for help. Taking control of your debt is a courageous step, and having a supportive team can make all the difference.

In the journey to tackle debt, patience and persistence are your best allies. Progress might be slow at first, but each payment brings you one step closer to financial freedom. Remember, you're not just paying off debt; you're building a future where you're in control of your finances, not the other way around. And that's a journey worth undertaking.